Campus network loan is one of the fastest growing products of Internet finance in recent years. As long as you are a student in school, you can easily apply for a credit loan by submitting materials online, passing the review, and paying a certain transaction fee.

Non-performing credit, which is commonly referred to as campus non-performing online credit, it usually wears a seductive and charming coat, claiming to be convenient to apply, simple in procedures, and quick in disbursement, shouting to spend tomorrow's money and fulfill today's dream, there will always be a slogan that satisfies you, like financial drugs that can make college students unable to stop. At present, various problems with campus online loans are caused by these non-performing loans.

The following video reveals the risks and harms of online loans. For college students who urgently need money and lack financial and legal knowledge, it is extremely easy to fall into the trap of online loans. Please click the link to watch the video to learn about potential pitfalls and fraud related to loans, which can help you make wise decisions regarding loans. Please establish a correct view of money, eliminate the greedy demon in your heart, and carefully balance financial needs. Share this video with your friends to remind everyone that online lending carries risks and borrowing should be done with caution.

Analysis of Criminal Techniques:

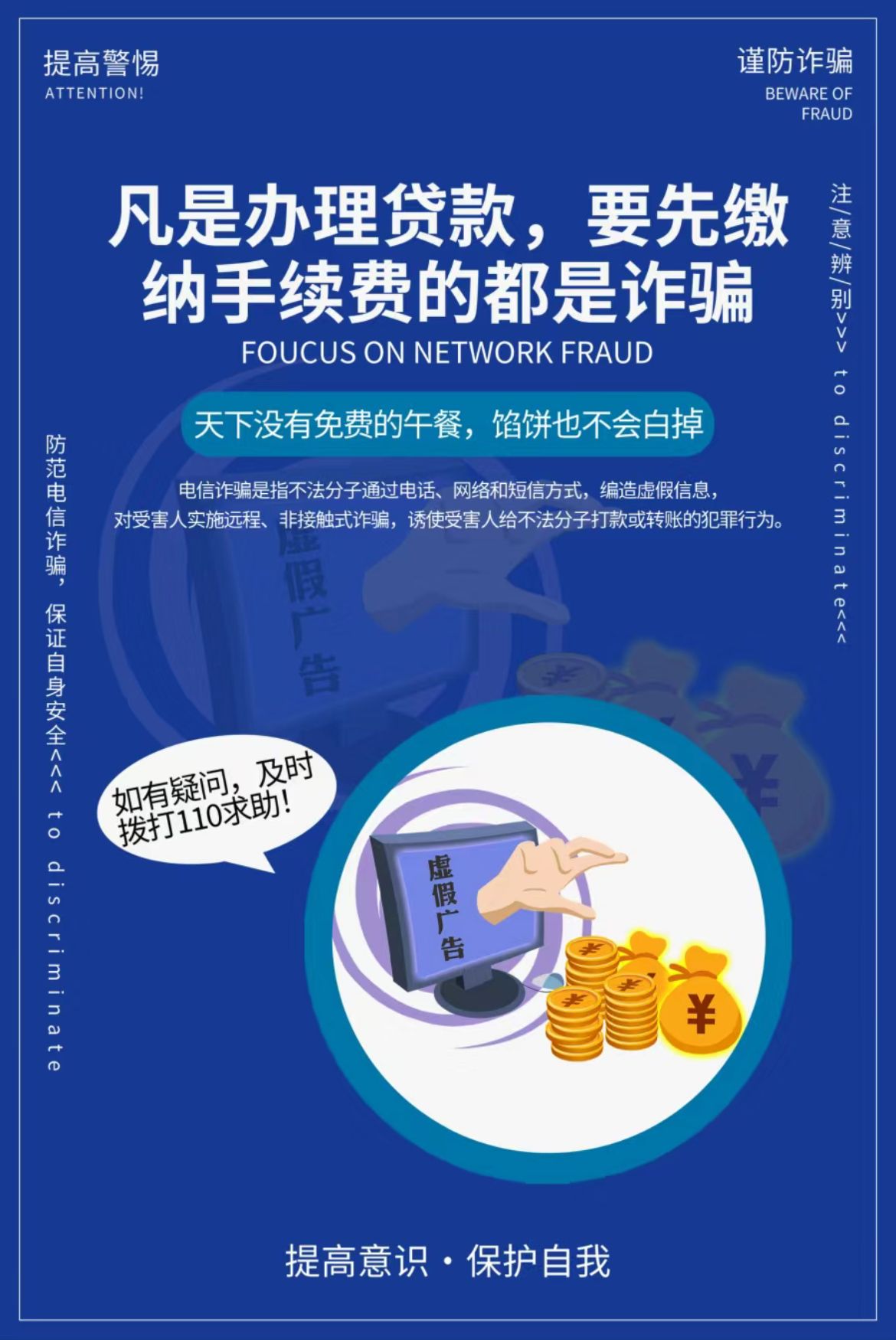

Step 1: Scammers will use the guise of "no collateral", "no guarantee", "instant payment", and "no credit check" to attract you to download fake loan apps or log in to fake loan websites.

Step 2: Ask you to pay various fees in the name of "handling fees, transaction fees, deposit, and unfreezing fees".

Step 3: When the scammer receives the money you transferred, they will close the scam app or website and blackmail you.

1. Do not trust unfamiliar calls or text messages, and do not click on any loan links or advertisements with unknown sources.

2. Any online loan advertisement claiming to be "unsecured", "zero threshold", or "low interest rate" carries great risks.

3. When applying for a loan, it is necessary to go to a qualified financial institution and do not trust unfamiliar phone calls, text messages, or online advertisements!

4. Legitimate loans do not charge any fees before disbursement. During the loan process, anyone who requests to transfer money in the name of paying "handling fees, card making fees, security deposits, unfreezing fees" is considered fraudulent.

5. Do not provide your bank card password or dynamic verification code to strangers!

视频:FELICIA MARGARETHA PUTRI(许忆美)

编辑:邢露萍(海外教育学院)

审核:朱丹